Other Topics That Might Interest You

See all

News

15

Sep

25

Solving for Complexity: Axon Ivy’s Approach to Real-World IPO

In an era where automation alone no longer delivers a decided strategic advantage, enterprises are shifting their focus ...

Read more

Digital Process Excellence: Why Market Leaders Go Beyond the Standard

Uncover hidden efficiency killers: Why standard software slows you down—and how smart automation puts your business back ...

Read more

Digitalization Requires More Than Just Projects

Why true digital transformation requires more than isolated initiatives and how the right balance between strategic ...

Read more

News

29

Aug

25

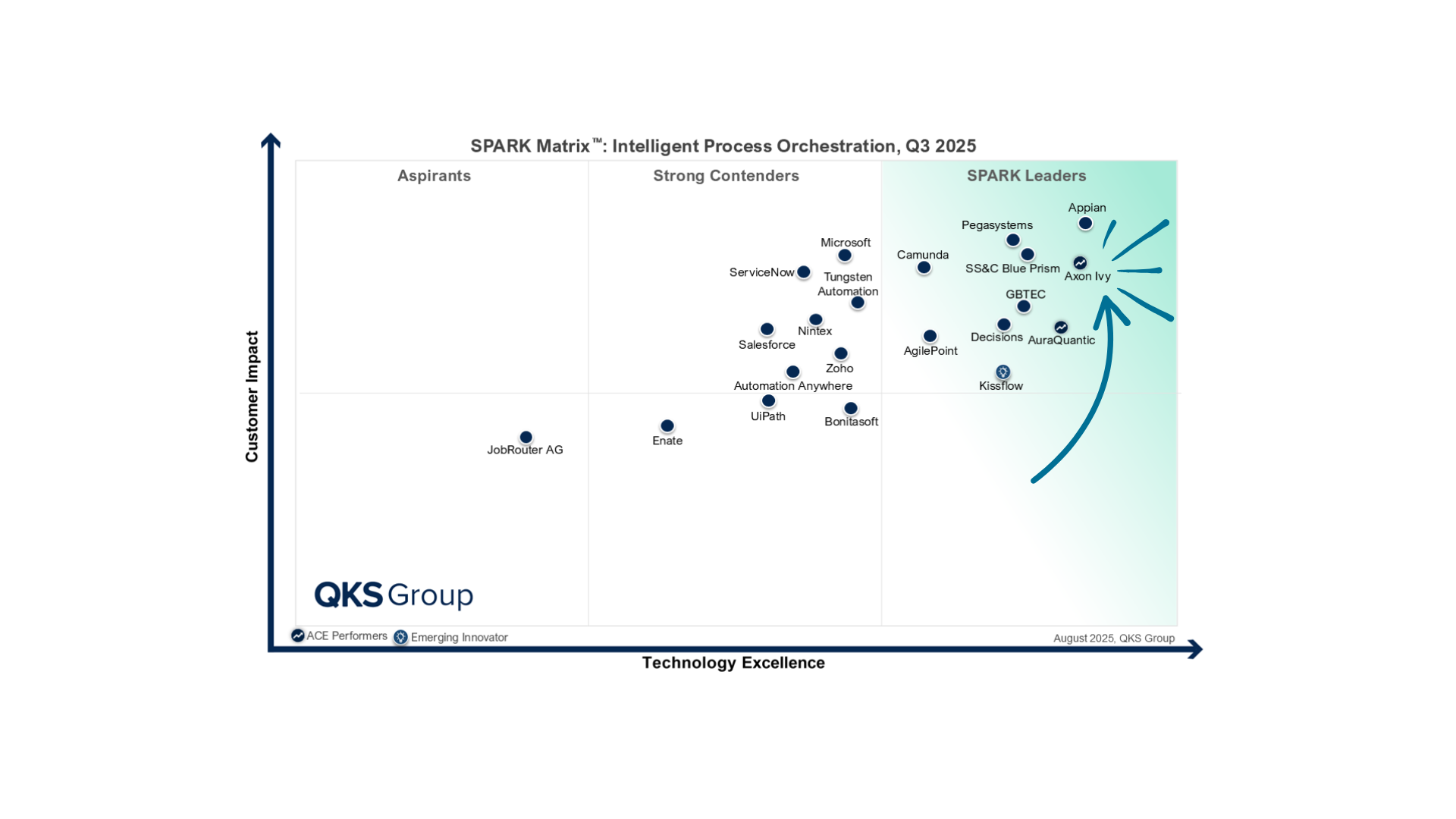

Axon Ivy: Technology Leader and Ace Performer in the 2025 SPARK Matrix

Axon Ivy has done it again! We have received two honors in the prestigious QKS Group SPARK Matrix™ Report 2025: Technology ...

Read more

Going Digital Isn’t Enough: Why HR Still Falls Behind

The Challenge: According to McKinsey, 60% of HR resources are tied up in manual tasks, leaving only 10% for strategic ...

Read more